Gatineau a bargain vs Ottawa ?

12 Sep 2023

Gatineau a bargain vs Ottawa ?

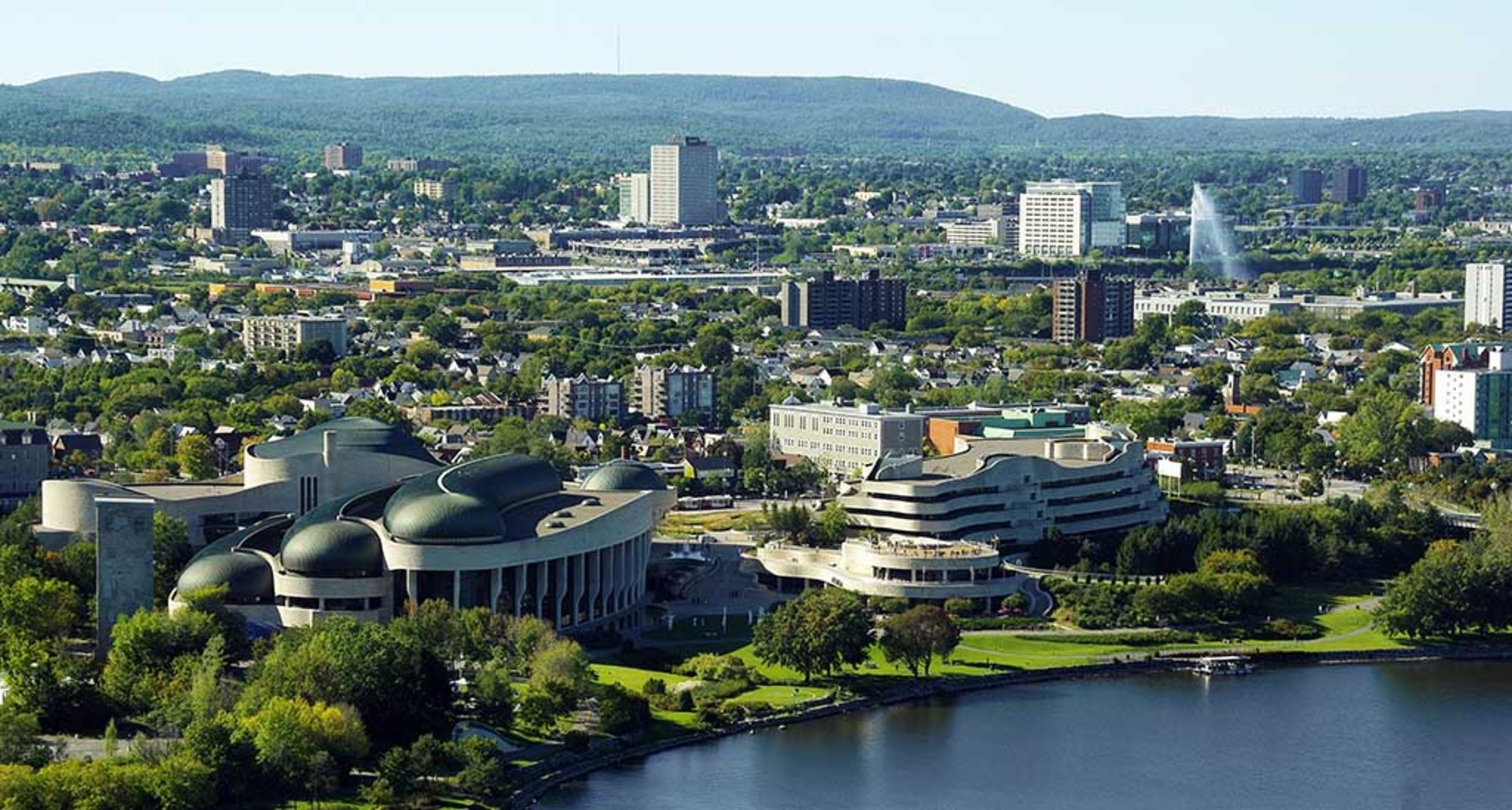

Which offers better financial value — a primary residence in Gatineau or Ottawa? For residents of the National Capital Region, it's an age-old question.

Until the pandemic Ottawa residents were fine with the economics. Buyers from Ottawa each year accounted for just six per cent of all home purchases in Gatineau. But, as with so many other things, the virus has upended a long-running balance.

During the first year of the pandemic, the premium for Ottawa properties over those in Gatineau surged to 65 per cent, according to the CMHC. The result: the number of Ottawa residents buying homes in the Gatineau area nearly doubled to 680 in 2020, representing roughly 11 per cent of the market. The price has since likely widened. It seems the economics have shifted in favour of Gatineau.

Let’s have a look at the math. Consider first the size of the income tax gap that must be overcome when moving from Ontario to Quebec. Statcan estimates that the average salary for an Ottawa resident in 2019 was $61,620 — based on information filed by taxpayers. That would have increased to roughly $64,000 last year, assuming increases in line with inflation. According to Ernst & Young, that salary would have produced a federal-provincial tax bill of $11,840 in Ontario and $15,200 in Quebec (excluding most non-refundable credits). So a move to Quebec would cost you $3,360 in additional income taxes, or $280 per month.

Now look at the savings from house costs. The average price of an Ottawa residence last year topped $780,000. If you had built up 20 per cent equity, you would have a $624,000 mortgage. Assuming a special five-year variable rate of 2.05 per cent (offered by TD Bank in 2022) and a 25-year amortization, that would cost you $2,848 per month.

Now, if you sold your Ottawa home and bought one in Gatineau, you would be considerably better off financially. Applying your $156,000 in home equity against the $466,000 median price of an Aylmer house would leave you with a mortgage of $310,000. Then add about $50,000 in real estate fees and moving costs, gives you $360,000 worth of mortgage debt.

Using the same five-year variable rate as above, your mortgage would have been $1,657 per month — a net saving just shy of $1,200 per month. You would also likely save a bit more because your property taxes would be lower, courtesy of a smaller assessed value for your new home. The difference would be even more today with the higher interest rate (around 5,5% for a 5 year rate).

Source: Ottawa Citizen 2022